Learn about the importance of Zakat, how to donate Zakat, and how to use our Zakat Calculator.

What is Zakat?

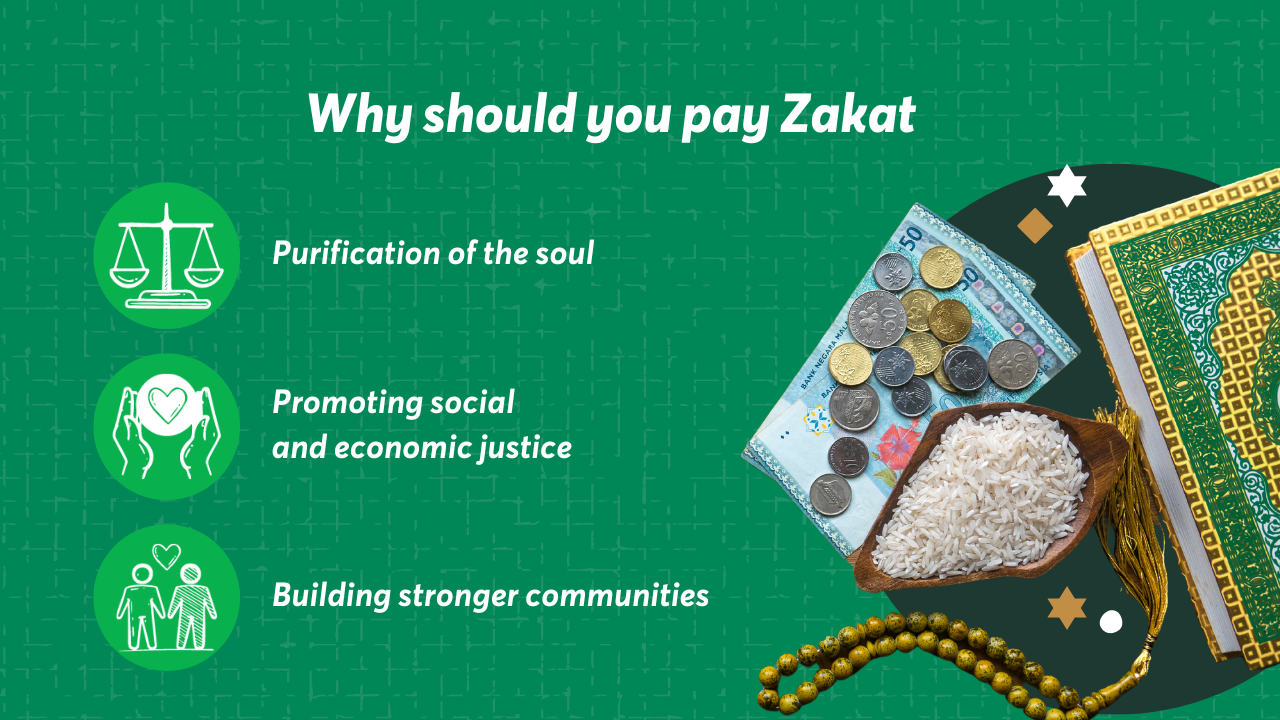

Zakat is a fundamental pillar of Islam, emphasizing the importance of charity and social welfare in the Muslim community. Derived from the Arabic word meaning “purification” or “growth,” Zakat serves as a means of purifying one’s wealth and assisting those in need.

It is an obligatory form of almsgiving in Islam, mandated for all financially capable Muslims. It represents a fixed percentage (2.5%) of an individual’s accumulated wealth and assets, excluding essentials such as personal residence, furniture, and clothing. The purpose of Zakat is multifaceted: it aims to redistribute wealth, alleviate poverty, promote social justice, and purify one’s wealth.

Keep reading to learn about the meaning of Zakat, where your donation goes, and using a Zakat Calculator.

Ibn ‘Abbaas said,

The Messenger of Allah ﷺ made Zakat al-Fitr obligatory as a means of purifying the fasting person from idle talk and foul language, and feeding the poor. Whoever pays it before the prayer, it is an accepted zakah, and whoever pays it after the prayer, it is just a kind of charity (sadaqah).

Abu Dawood

How to Calculate Zakat

The calculation of Zakat involves several key steps:

1. Assessing Wealth and Assets: Individuals must evaluate their total savings and assets, including cash, gold, silver, property, stocks, and other valuable possessions.

2. Determining Nisab: Nisab refers to the minimum threshold of wealth that qualifies for Zakat. It is equivalent to the value of 87.48 grams of gold or 612.36 grams of silver.

3. Applying Zakat Rate: Once Nisab is established, Zakat is calculated at a rate of 2.5% or 1/40 of the individual’s total savings and wealth.

4. Using a Zakat Calculator: To simplify the process, IDRF provides you with a seamless Zakat Calculator, which you can use to determine the precise amount of Zakat owed. Click here to calculate your Zakat today.

Assets Subject to Zakat

Zakat applies to various assets and possessions, including:

- Cash savings and liquid investments.

- Business assets, such as stock, inventory, and raw materials.

- Gold and silver, irrespective of form (jewelry, coins, ingots).

- Other forms of wealth, including cryptocurrency holdings and foreign currencies.

Exemptions and Deductions for Zakat

While Zakat encompasses a wide range of assets, certain exemptions and deductions are allowed:

- Personal items essential for daily living, such as primary residence, furniture, and clothing, are exempt from Zakat.

- Liabilities, including outstanding debts, rent, utility bills, and business expenses, can be deducted from Zakat calculations.

The Impact of Your Zakat

The impact of Zakat extends beyond individual obligations, playing a vital role in addressing socio-economic disparities and fostering community welfare. When you give your Zakat to IDRF, you directly contribute to:

- Economic Empowerment.

- Improving Healthcare Accessibility

- Community Development

- Clean Water Accessibility (water wells, water trucking, water purification, etc)

- Sustainable Food Programs

Your consistent support allows communities to break free from the cycle of poverty, empowering them to stand on their own feet.

Zakat embodies the principles of compassion, justice, and social responsibility in Islam. By fulfilling their Zakat obligations, Muslims not only purify their wealth but also contribute to the well-being and prosperity of society. Through conscientious giving, Zakat serves as a transformative force, addressing poverty and inequality — building a more equitable and compassionate world.

Quick Links